OECD has published a document "CoVID-19 Crisis in Montenegro". Here are their findings on socio-economic issues in Montenegro Montenegro Anti-Covid19 measures Developments: On 25 April 2020, the National Coordination Body announced the plan to mitigate measures in four phases (the first phase covering the lockdown measures), with the final aim to

Tag: Tax

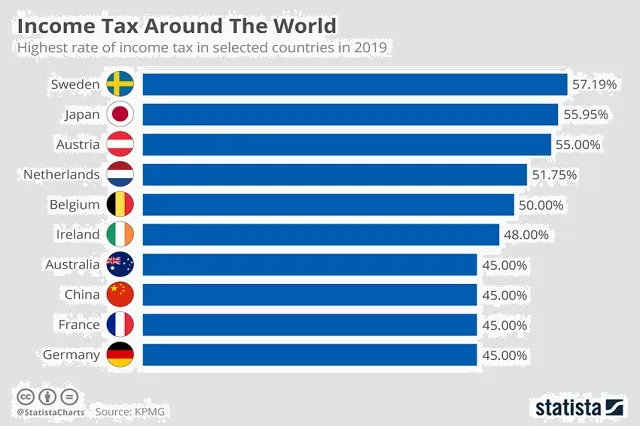

Which countries tax their citizens the most?

Which countries tax their citizens the most? Which countries tax their citizens the most? Where do taxpayers pay the highest income taxes? In 2019, the highest income earners in Sweden pay a whopping 57.19 percent, more than anywhere else in the world. This is significantly more than the OECD average of 41.65

Taxation: Council revises its EU list of (non)cooperative jurisdictions

European Commission’s Economic Quarterly on Montenegro 4Q 2019

EU Candidate Countries’ & Potential Candidates’ Economic Quarterly - Montenegro data The European Commission has published the EU Candidate Countries’ & Potential Candidates’ Economic Quarterly (CCEQ). Here are the Montenegro data: Key developments mentioned in the quarterly report: On 11 October, the government called a pre-qualification tender for a

OECD: Montenegro joins Inclusive Framework on BEPS

t the OECD Headquarters in Paris, Biljana Peranović, Director General of the Directorate for Tax and Customs of Montenegro, signed the multilateral Convention on Mutual Administrative Assistance in Tax Matters (the BEPS Convention). Montenegro is the 130th jurisdiction to join the Convention. The Convention enables jurisdictions to engage in a

EU Budget 2020 Approved

EU Budget 2020: investing more in climate, jobs and the youth in focus Over €500 million more dedicated to climate action Support for the young: boosting Erasmus and the fight against youth unemployment Last annual budget of current financial framework 2014-2020 For next year’s EU budget, MEPs have secured better support

EC on Montenegro – More balanced growth ahead

European Commission has published fall 2019 economic forecast. Among assessed countries was also Montenegro, a candidate country for the next EU enlargement. The completion of the first section of the Bar-Boljare highway in 2020 will conclude a six-year period of fast expansion of the economy, but also of high external and

EU trade policy & globalization efforts explained

How many US dollars are in circulation today?

Work-Life balance: Denmark case

"Something is rotten in the state of Denmark", goes the line in Shakespeare's Hamlet. But four centuries after the play was written, the analysis couldn't be less accurate. According to the OECD Better Life report, Danes have a better work-life balance than any other country surveyed. nly 2% of employees regularly work very long

Swedish start-ups explained

Q: What do Spotify, Minecraft and Candy Crush Saga have in common? A: They are all made in Sweden Sweden is home to Europe’s largest tech companies and its capital is second only to Silicon Valley when it comes to the number of “unicorns” – billion-dollar tech companies – that it produces per capita. Skype was

EC: Montenegro’s Economic Quarterly

The European Commission published EU Candidate Countries’ & Potential Candidates’ Economic Quarterly (CCEQ) technical report which indicates macroeconomic development of potential countries. Like other European Economy Technical Papers, Q2 2017 report was compiled by the staff of the European Commission’s Directorate-General for Economic and Financial Affairs. Montenegro's economy are indicated as the