English available languages

English available languages

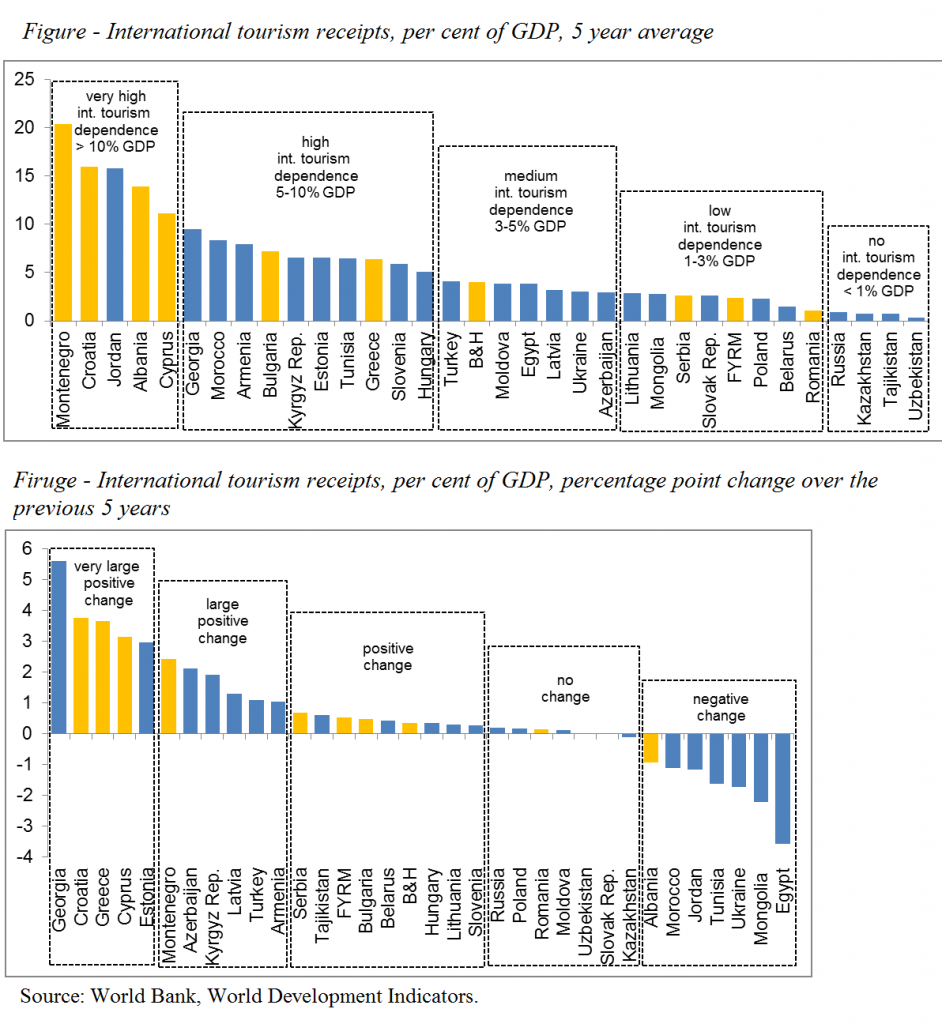

Tourism is an increasingly important source of revenue and driver of growth in many countries in the EBRD region, and especially in the South-Eastern Europe (SEE). Receipts from international tourist arrivals account for more than 10 per cent of GDP in several countries in SEE, with a substantial upward trend in the past five years. In light of the security risks in other popular markets, SEE can expect to see further rises in tourism in the coming years, which would help consolidate the economic recovery under way in the region. However, a recent World Economic Forum report on competitiveness in the travel and tourism industry highlights important shortcomings associated with weak price competitiveness, a problematic business environment, inadequate infrastructure and low prioritization of tourism industry. Addressing these problems would help the SEE region come closer to achieving its full potential in this important industry.

South-Eastern Europe is the largest tourist destination in the EBRD region. Tourism has become an increasingly important source of revenue and employment across the EBRD region, which now accounts for 20 per cent of more than 1 billion global international tourist arrivals. Within the EBRD region, SEE accounts for one quarter of these arrivals, or 59 million. SEE has also experienced the largest increase over the last five years, with an increase in arrivals of around 15 million since 2010. Access to the Mediterranean Sea and close proximity to the main source markets of Western Europe and Russia are prominent factors behind the region’s popularity as a major tourist destination.

The tourism sector is a major source of economic activity in many SEE countries. Receipts from foreign tourist arrivals account for more than 5 per cent of GDP in six countries: Montenegro, Croatia, Albania, Cyprus, Bulgaria and Greece. The sector is also a major source of employment. These countries attract a large number of European summer holiday tourists, and the importance of international tourist receipts has increased significantly since 2010, especially in Croatia, Greece, Cyprus and Montenegro . These countries are likely to be benefiting from the political turmoil across rival destinations in the Southern Mediterranean. In addition, the perceived increasing threat from terrorism has diverted European and Russian travellers towards destinations closer to home.

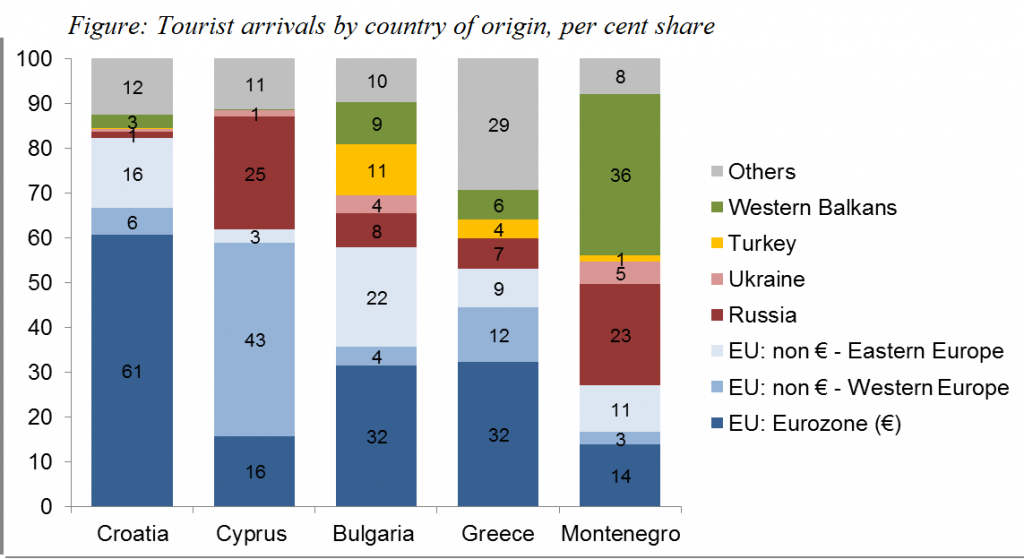

Eurozone countries are the primary source of tourism for Croatia, Bulgaria and Greece while Russia accounts for about one-quarter of all tourist arrivals to Cyprus and Montenegro. More than 80 per cent of tourist arrivals in Croatia are from the EU, mostly from the Eurozone. In contrast, only 30 per cent of international tourist arrivals to Montenegro are froTravm the EU. Instead, Russia and the Western Balkans (Serbia in particular) together account for about half of all arrivals in Montenegro. Cyprus is another country highly dependent on Russian tourists, as well as those from the UK, while Eastern Europeans and Turkish visitors are relatively important for Bulgaria. The share of non-European tourists is largest in Greece.

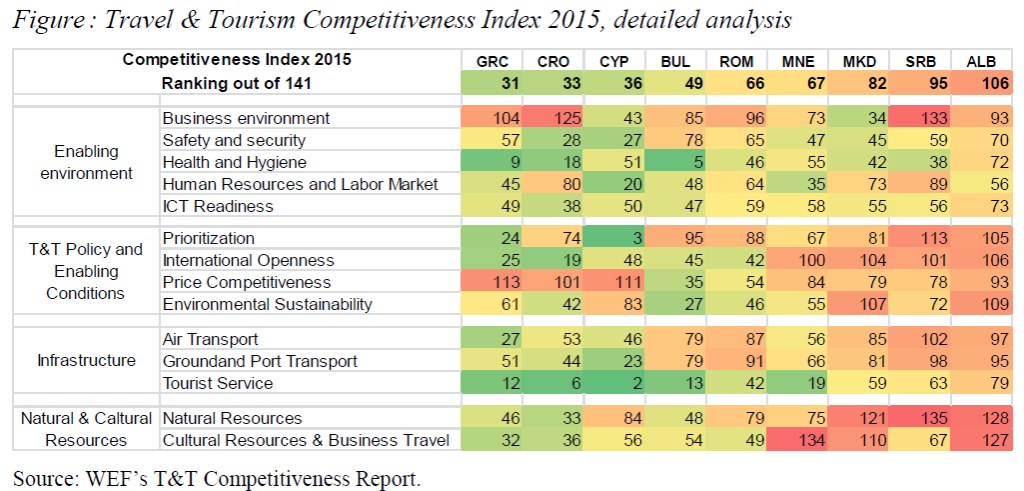

SEE countries face a competitiveness problem in the tourism industry. Cross-country competitiveness in the tourism sector can be assessed by using the World Economic Forum’s (WEF) Travel and Tourism (T&T) Competitiveness Index.

The figure shows the ranking of SEE countries. Greece, Croatia and Cyprus are amongst the top 40 economies in the world (ranked in 31st, 33rd and 36th position, respectively), Bulgaria, Romania and Montenegro are at the lower end of the upper 50 percentile, and remaining SEE countries perform relatively poorly. All SEE countries are less competitive in tourism than other traditional holiday destinations in the northern Mediterranean, such as Spain, France, Italy and Portugal.

A number of shortcomings in the tourism sector stand out. Greece, for example, stands out as the least price competitive country in the region, with Cyprus also being a costly destination. Croatia’s poor business environment has the largest negative effect on its T&T competitiveness. In the Western Balkans, major bottlenecks for further tourism development exist because of the relatively low quality of ground infrastructure and the underdeveloped air transport network. Nonetheless, improvements in recent years have produced positive results for the local tourism industry, and governments in this part of the SEE region have begun to promote their countries more actively. As infrastructure improves, this strategy should pay off in terms of substantially increased tourism revenues.

Source: EBRD: Tourism in south-eastern Europe – driving the recovery Report

English available languages

English available languages