Crnogorski

Crnogorski English available languages

English available languages

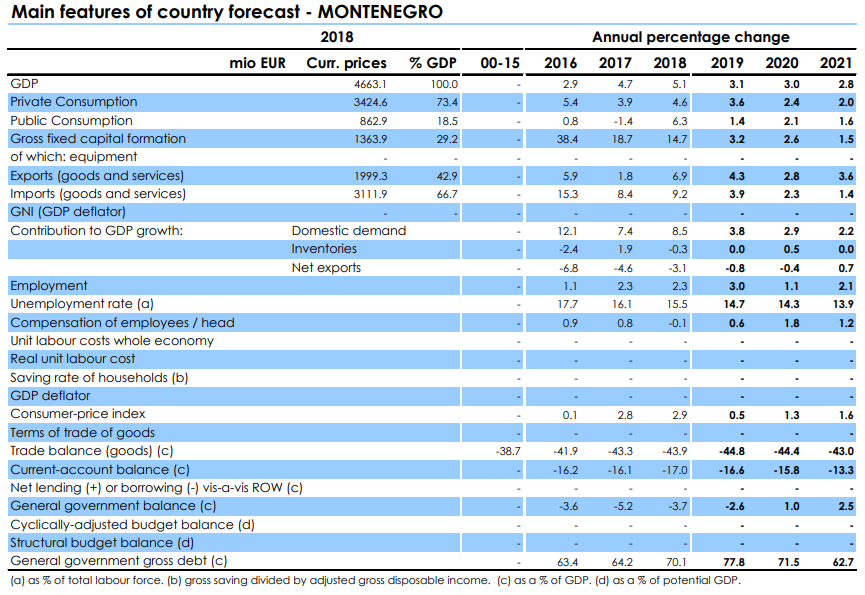

European Commission has published fall 2019 economic forecast. Among assessed countries was also Montenegro, a candidate country for the next EU enlargement.

The completion of the first section of the Bar-Boljare highway in 2020 will conclude a six-year period of fast expansion of the economy, but also of high external and fiscal deficits driven by this major public investment. With the end of the construction works, it is expected that economic growth will decelerate while becoming more balanced, with corporate investment and private consumption driving growth and employment. The external and public sector balances are set to improve.

Rebalancing growth drivers

Economic growth slowed to 3.1% y-o-y in the first half of 2019, down from 4.8% y-o-y a year before. The deceleration reflects a decline in gross fixed capital formation, a major engine of growth until recently. This was due to a very large base effect, as investment (including both public and private

ones) surged in the same period a year before. In spite of stagnating wages, private consumption remains strong thanks to improving labor market conditions and sustained credit growth to households. Notwithstanding the announcement of fiscal consolidation efforts, government consumption recorded some further expansion over the year. On the external side, exports kept growing at double the pace than imports. As a result, the negative contribution from net exports narrowed to 0.4 pps of GDP in the first half of 2019, down from a 1.6% pps drag a year before.

More sustainable growth dynamics

Going forward, annual output growth in 2019 and 2020 is set to decelerate to around 3%, mainly due to weaker construction activity as the investment cycle related to the Bar-Boljare highway is gradually phasing out. At the same time, corporate investment, in particular in the tourism and energy sectors, is expected to remain strong, providing some offset to decreasing spending on public works. Moreover, preliminary results of the rationalization of public administration suggest a lower-than-expected negative impact on employment as well as on private consumption. Private consumption growth is set to benefit from positive wage and employment trends, in particular in the tourism and construction sectors. The global economic slowdown represents a downside risk for Montenegro’s growth forecast in case of a larger than expected impact on tourist arrivals and/or FDI inflows.

Low inflation environment

Price dynamics are forecast to soften considerably in 2019, partly due to the high base effect from last year’s VAT and excise hikes. The increase of the minimum wage in July 2019, and the continued rise of household consumption, are set to lead to moderately increasing price pressures in 2020 and 2021.

Easing of external imbalances

The slowdown of the European car industry is already being reflected in a reduction of Montenegro’s export of basic metals and machinery. However, this trend is being offset by the strong performance of Montenegrin exports of services, and of tourism in particular. The completion of the highway works announced for September 2020 is expected to reduce substantially the volume of construction-related imports. However, while the current account deficit is set to improve, it is projected to remain in the double-digits.

Supportive financial conditions

The resolution of two troubled domestic banks was implemented in an orderly way without disruption to the rest of the financial system. In light of ample liquidity, strong capital buffers, and declining NPL ratios, the banking sector is expected to remain supportive to growth with sustained lending activity during the forecast period.

Budget set to turn to surplus

Substantial capital budget under-spending and improved revenue collection resulted in a sharp reduction of the budget deficit in the first half of 2019, to 0.8% of full-year GDP compared to a 4% gap in the same period a year before. It is expected that capital spending will catch up with the original budget plan by the end of the year and, consequently, the consolidated budget deficit will increase to some 2.5% of GDP in 2019. The sharp reduction of public investment as of 2020 would have a negative impact on economic growth, but it is also expected to bring about a modest budget surplus by the end of the year, and a substantially larger one in 2021. Public debt remains high and is still growing in 2019, boosted also by the issuance of sovereign debt under the prevailing favorable terms to build-up government reserves and to refinance public debt maturing in the next two years. The improving budget balance and the draw-down of deposits are expected to substantially reduce public debt in 2020-2021, although not below 60% of GDP.

Crnogorski

Crnogorski English available languages

English available languages