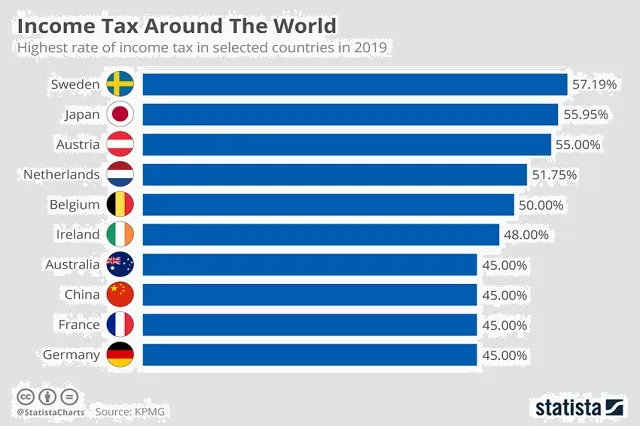

Which countries tax their citizens the most? Which countries tax their citizens the most? Where do taxpayers pay the highest income taxes? In 2019, the highest income earners in Sweden pay a whopping 57.19 percent, more than anywhere else in the world. This is significantly more than the OECD average of 41.65

Tag: Double taxation

Taxation: Council revises its EU list of (non)cooperative jurisdictions

Commission to tackle tax discrimination against mobile EU citizens

Commission to tackle tax discrimination against mobile EU citizens Tax discrimination still present in the EU? Member States' tax provisions are to be scrutinized to ensure that they do not discriminate against mobile EU citizens, in a targeted initiative launched by the Commission. The focus is on both economically active individuals

Q&A: The protection of EU financial interests and the fight against fraud

Council approves measures to tackle VAT fraud schemes

The Council has adopted two directives that will enable member states to better combat VAT fraud, facilitating rapid reaction and allowing a specific measure to tackle so-called "carrousel fraud". The importance of such measures amongst a number of initiatives aimed at better combating tax evasion and tax fraud was highlighted